Are you ready to take your personal finance game to the next level? In this article, I’ll explore the exciting world of next-generation personal finance tools and strategies. From budgeting apps to robo-advisors, the future of managing your money is here, and it’s more accessible and efficient than ever before.

Gone are the days of complicated spreadsheets and tedious manual tracking. With the latest advancements in fintech, I’ll show you how you can streamline your financial life and make smarter decisions with just a few clicks. Stay tuned as I delve into the innovative technologies and trends shaping the way we save, invest, and plan for the future.

Next Generation Personal Finance

Personal finance tools have come a long way in recent years, evolving alongside technological advancements. Gone are the days of tedious manual tracking and complex spreadsheets. Innovative fintech solutions have revolutionized the way individuals manage their finances, offering convenience, accessibility, and efficiency.

Here are some key milestones in the evolution of personal finance tools:

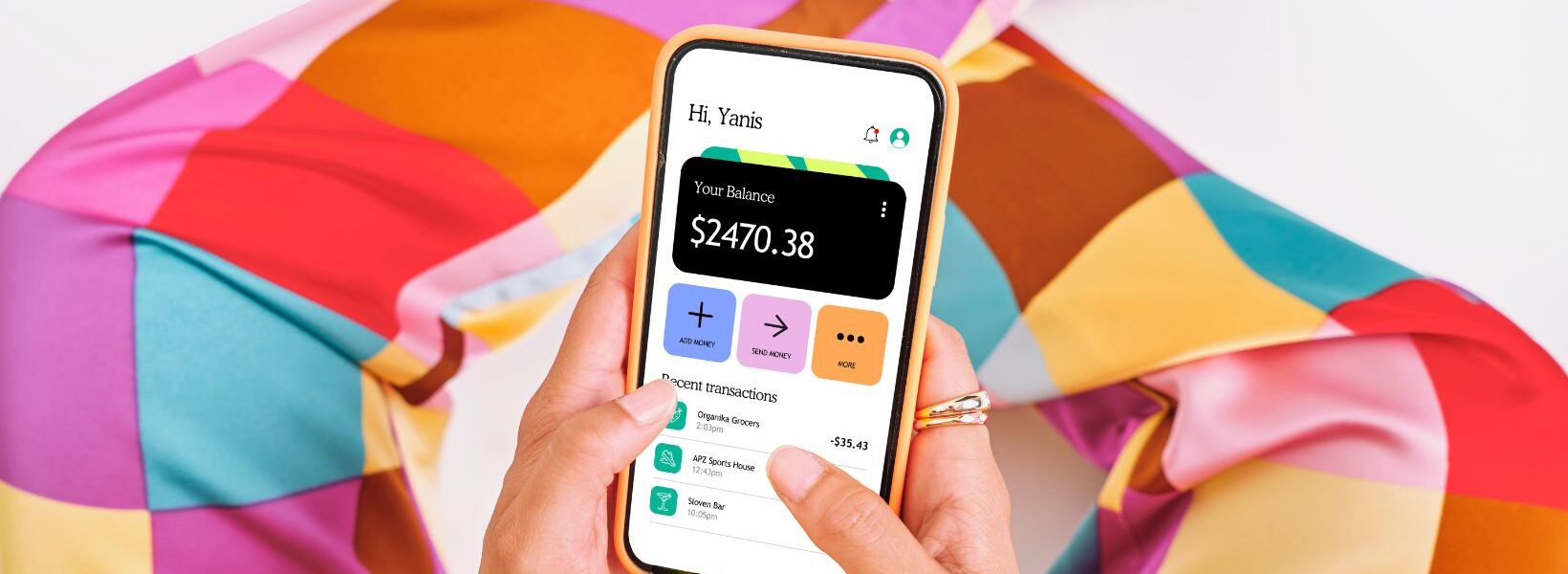

- Emergence of Mobile Apps: The rise of mobile apps has made it easier than ever for individuals to track their spending, set budgets, and monitor their investments on the go.

- Automation and AI: Artificial intelligence and automation tools have enabled personalized financial recommendations and automated savings strategies, taking the guesswork out of money management.

- Integration of Financial Data: Today, personal finance tools can seamlessly integrate with bank accounts, credit cards, and investment accounts, providing a comprehensive view of an individual’s financial health in one place.

- Robo-Advisors: Robo-advisors have democratized investment management, offering low-cost, automated portfolio management services based on individual financial goals and risk tolerance.

- Blockchain and Cryptocurrency: The advent of blockchain technology has paved the way for decentralized finance (DeFi) applications, allowing individuals to access a range of financial services without traditional intermediaries.

- Personalized Financial Insights: Advanced analytics tools offer personalized insights into spending patterns, investment performance, and savings goals, empowering individuals to make informed financial decisions.

The evolution of personal finance tools continues to reshape the way people engage with their finances, making it easier and more accessible to achieve financial wellness and security.

Benefits of Next-Generation Finance Strategies

Embracing next-generation finance strategies brings numerous advantages:

- Increased Efficiency: Automation streamlines tasks, saving time and reducing errors.

- Enhanced Accessibility: With mobile apps and online platforms, managing finances is convenient anytime, anywhere.

- Personalized Recommendations: AI analyzes data to offer tailored financial advice.

- Holistic View: Integration of various accounts provides a comprehensive financial snapshot.

- Automated Investing: Robo-advisors offer hands-free investment management.

- Decentralized Finance: Blockchain technology enables secure, peer-to-peer transactions.

- Advanced Analytics: Receive insights tailored to your financial goals and habits.

These benefits empower individuals to take control of their finances with ease and confidence.

Introduction to Budgeting Apps

When it comes to managing personal finances, budgeting apps play a pivotal role in providing individuals with real-time insights into their spending habits. These apps offer a convenient way to track expenses, categorize transactions, and set financial goals. With the rise of mobile technology, budgeting apps have become essential tools for individuals looking to stay on top of their finances.

Personalized budgeting apps utilize data analytics to offer tailored recommendations based on an individual’s spending patterns. By integrating multiple financial accounts, these apps provide a comprehensive view of one’s financial standing, making it easier to make informed decisions. Through automation features, users can set up alerts for bill payments, monitor subscriptions, and even receive suggestions for saving opportunities.

The Rise of Robo-Advisors

Robo-advisors are automated platforms that provide personalized investment advice and manage portfolios using algorithms. They have gained popularity for their convenience and cost-effectiveness compared to traditional financial advisors. With minimal human intervention, robo-advisors analyze financial data, risk tolerance, and investment goals to create diversified portfolios tailored to individual needs.

These digital platforms offer 24/7 accessibility, allowing users to monitor investments and make changes anytime, anywhere. Low fees make robo-advisors an attractive option for new investors, who may not have substantial assets to qualify for traditional advisory services. Furthermore, robo-advisors utilize tax-loss harvesting strategies to optimize returns and minimize tax liabilities for investors.